It’s not too soon to say that COVID-19 is likely one of the defining events of 2020 and its implications on social and economic issues will last well into the decade. Amid apparent challenges caused by the pandemic, the question is “When is everything going back to normal?”. The answer may be “Never”. Because life will go back to normal, but “a new normal” with newly adopted habits and behaviors. We have compiled from reliable sources stats, facts, and insights into what is changing in consumer behavior changes after COVID-19.

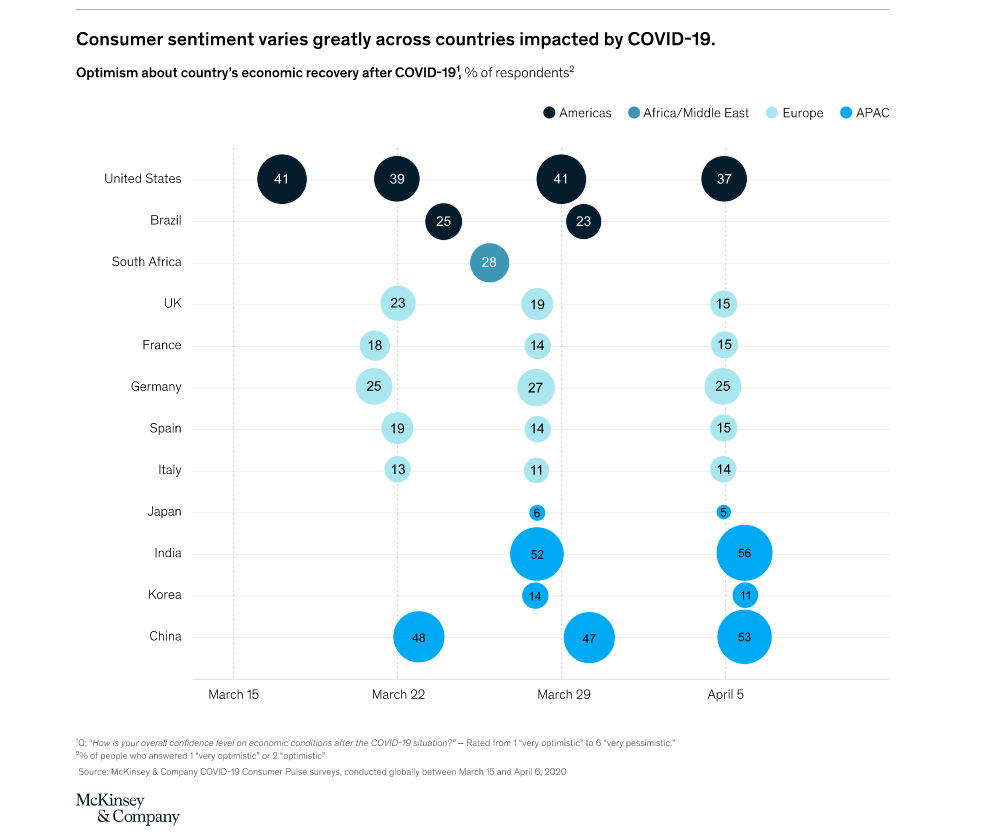

Consumer sentiment about the country’s recovery

McKinsey has researched consumers in 38 countries since mid-March to track their sentiment, income and spending habits during the crisis. Results show that consumers in European countries that COVID-19 has hard hit are least optimistic about their nation’s capability to recover from the pandemic’s impact and bounce back to normal, among the least are the UK, Spain, and Italy. Whereas people in the US and China are showing a more optimistic view of their economic recovery to normal in the next few months.

Other reliable insights are taken from recent research from on-demand consumer insights platform Suzy on consumer spending changes across the United States, according to which 72% of Americans are now “very concerned” about COVID-19 (compared to only 47% 2 weeks earlier). With the concern setting in, 59% of consumers believe that the pandemic will last up to three months, 25% think that it will last four to six months, and 10% believe that it may last over six months. The negative impact of the COVID-19 crisis is believed to last several more months even when the crisis has ended.

Consumer’s spending amount and categories

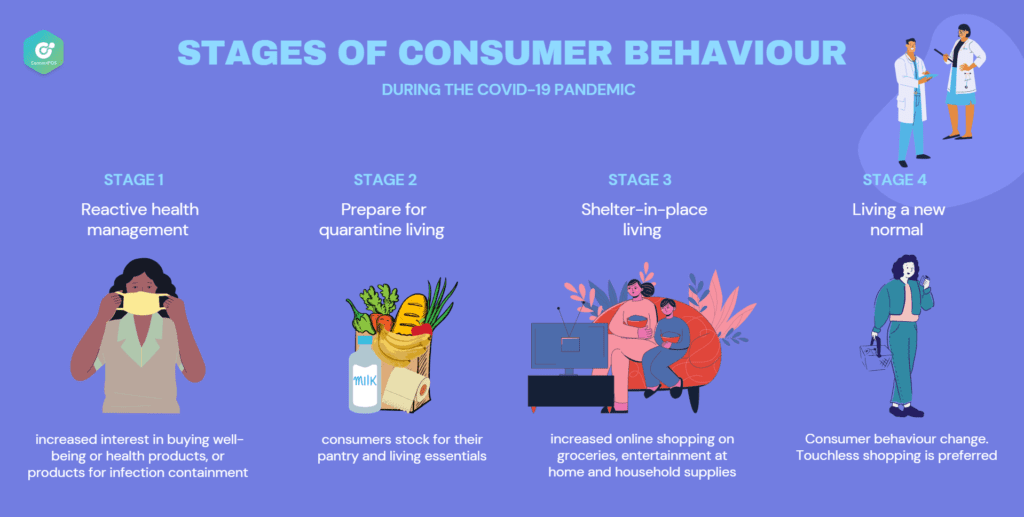

Consumer behavior during the pandemic can be separated into several stages:

- Stage 1: Reactive health management due to first awareness of the COVID-19 spread in their communities. This stage witnessed increased interest in buying well-being or health products, such as supplementary vitamins or products for infection containment, such as face masks or hand sanitizers.

- Stage 2: Preparation for quarantine living. People increased their visits to stores to stock their pantry and living essentials.

- Stage 3: Restricted living. Due to shelter-in-place orders, consumers started to increase online shopping. Preferred spending categories go to groceries, entertainment at home and household supplies

- Stage 4: Living a new normal. As the world is moving through the pandemic, “What now?” – That may be the question many retailers worldwide are asking. What changes does the pandemic cause in consumer behaviors? Which trends might be affected? What should be invested?…

Despite differences in optimism levels, consumers globally share the same pattern of reducing their spending. This might be due to their decreased income. Data insights show that nearly half of the UK residents plan to continue spending less in the next two weeks, while 46% of US consumers have the same intent. In the US, 54% of consumers are no longer considering the purchase of big-ticket items such as homes, cars, trips or luxury goods over the next three months. Instead, focused spending categories in the near future go-to essentials for home life and sanity, such as Food and Beverages, Household cleaning items or personal care items. The majority of their spending is focused online. This spending shift to online channels has been driven primarily by Gen Z, millennials, and higher-income earners.

More chances for touchless shopping habits

Increased health awareness is driving customers to adopt touchless shopping experiences that require less or no physical human interaction, such as cashierless stores, contactless or digital payment, or self-service PWA shopping.

Cashierless stores

Amid concerns over the COVID-19 spread, Amazon has recently announced in early March its cashier-less store technology, called “Just Walk Out”. The technology uses a combination of cameras, sensors, computer vision techniques and deep learning to ascertain what customers add to their carts.If shoppers put an item back to shelves after looking at it, Amazon will remove that item from shoppers’ virtual baskets. Then customers can pay for items and leave the store without waiting in line at a register to pay or contacting the cashiers. This is the same technology that today powers the Amazon Go cashierless convenience stores and Amazon’s newly launched Amazon Go Grocery store in Seattle.

Contactless and digital payment

Contactless and other digital payment methods are believed to become the preferred method, especially in countries where they were not popular before.

The USA is still in the early phase of adopting mobile payment. But COVID-19 side effects are speeding up this process. Americans, after years of reluctance, have finally begun to embrace digital wallets and contactless payment. Ireland consumers are also encouraged to switch their paying habits. In 2019, about 57% of Ireland under a survey showed their preference for using cash in the form of notes and coins over debit/credit cards or digital payment methods. However, social distancing has made cashless payment more popular. Ireland’s Financial Ministry has also raised the limit of contactless payment, enabling people to tap up to €50 instead of €30.

PWA self-shopping experience

PWA is a convergence of a regular web and a mobile app. People can access the online shops from their web browsers, and then shop with the interface of an app. No need to download any extra apps to their mobile devices. It allows customers to do their self-shopping on their mobile phones, scan barcodes for item detailed information, pay on their devices, and then choose between options of picking up the bought items at cashiers or having them delivered to their front doors. In this way, PWA self-shopping helps to reduce human contact or physical interaction.

So for now, retailers are considering PWA technology as a potential solution to attract customers to flock back to their brick-and-mortar stores, while still ensuring safety and social distancing. ConnectPOS clients have been advised on how to leverage ConnectPOS PWA Consumer App to their stores when they reopen after COVID-19.

So COVID-19 has hit us hard, but it is also blessing us with digital and omnichannel transformation. It’s driving consumer behaviors to change and adopt new digital habits sooner than we expected.

Is there anything we have missed? We are happy to hear your thoughts on this topic!

ConnectPOS is a all-in-one point of sale solution tailored to meet your eCommerce POS needs, streamline business operations, boost sales, and enhance customer experience in diverse industries. We offer custom POS with features, pricing, and plans to suit your unique business requirements.