This article explores the transformative impact of payment methods integration in clothing store point of sale (POS) systems. From traditional card transactions to cutting-edge digital wallets, the integration not only streamlines transactions but also enhances customer satisfaction. Join us on a journey to discover how the synergy of technology and payment diversity is elevating the overall retail experience in clothing stores.

Choose The Right Payment Methods Integration In Clothing Store Point Of Sale

In selecting the right payment methods for your clothing store point of sale, catering to diverse customer preferences and embracing the evolving landscape of retail transactions is imperative. Each method offers unique advantages, ensuring a seamless and tailored experience for traditional and modern shoppers.

Cash Payments

Cash stands as the primary method of payment due to its direct and uncomplicated nature. Unlike mobile and credit card payments gaining traction, a considerable number of customers still prefer the simplicity of cash transactions.

Debit and Credit Card Payments:

Embrace the shift towards debit and credit card transactions, as these bank-issued forms of payment gradually dominate the market.

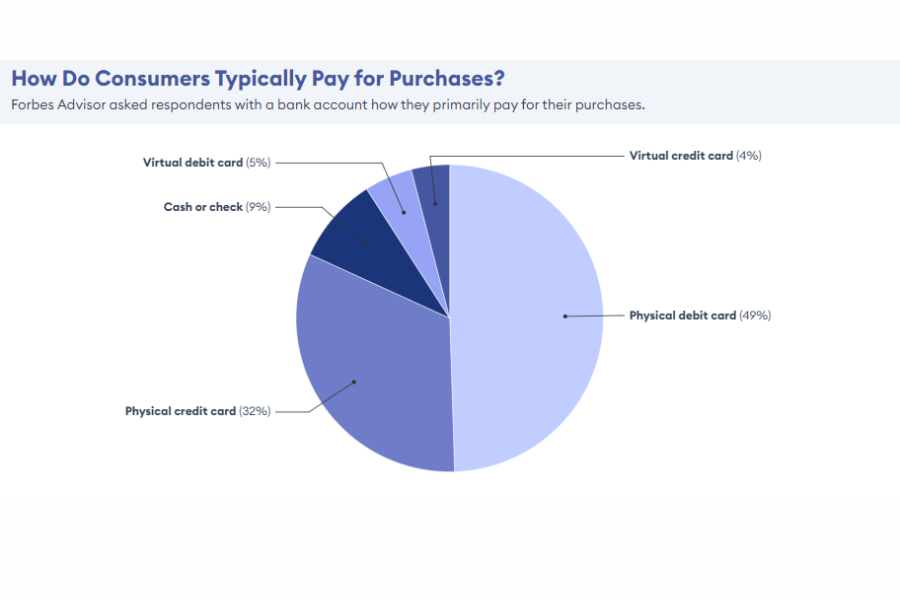

In a February 2023 survey by Forbes Advisor, it was revealed that a mere 9% of Americans predominantly rely on cash for their purchases.

The dominant payment methods are debit cards, utilized by 54% of consumers through physical or virtual means, and credit cards, preferred by 36% of consumers through physical or virtual options. To remain competitive, it’s essential to accommodate these preferences.

Mobile and Smartphone Payments

Stay ahead of the curve by integrating smartphone and mobile payments into your clothing store point of sale system. Recognized as contactless payments or mPOS, these methods, including Samsung Pay, Google Pay, and Apple Pay, have witnessed rapid growth.

Business Insider’s Mobile Payments Report highlights that in 2020, Americans using in-store mobile payments reached $150 million, constituting 56% of total in-store retail payment volume. Mobile payments offer a convenient, easy, and fast experience, aligning with customer habits as they regularly carry their phones.

Gift Cards, Store Credit, and Discounts

Move beyond traditional payment methods and recognize the power of gift cards, store credit, and discounts in building lasting customer relationships. Beyond acting as payment tools, these options prove instrumental for customer loyalty:

- Financial Leverage: Gift cards and store credits keep revenue within your business ecosystem, providing a share of income before the customer makes a purchase.

- Relationship Maintenance: Store credit helps maintain existing customer relationships, while gift cards serve as promotional tools to attract new customers.

- Flexibility In Transactions: Especially useful for product exchanges and returns, offering store credits or gift cards instead of cash refunds provides flexibility and encourages continued patronage.

Overall, strategic integration of payment methods is key to staying competitive and meeting customer expectations in the clothing retail sector.

By embracing this variety, your clothing store point of sale transcends the conventional, creating a space where the checkout process becomes not just a transaction but a personalized interaction. The ability to seamlessly accept both traditional and digital payment options positions your store at the forefront of consumer trends, ensuring convenience and choice for your customers.

Modernize Your Payment Experience In Clothing Store Point Of Sale

After recognizing the advantages of providing diverse payment choices, the next step is to determine the most suitable option for both your customers and your store.

Research from CustomerThink reveals that approximately 50% of shoppers may abandon their purchase if their preferred payment methods are not offered during checkout. To prevent significant revenue loss, retailers are advised to embrace as many payment methods as feasible.

Facilitating various payment methods becomes more manageable with a contemporary point-of-sale system equipped with flexible terminals. This approach contributes to:

- Enhanced customer experiences

- Increased likelihood of repeat purchases

Implementing a versatile clothing store point of sale system capable of handling transactions with ease allows you to seamlessly accept various payment methods while offering customized payment options, including:

- Split Payments: Enable two customers to collectively pay for an item using two debit or credit cards, or split a bill among multiple credit cards.

- Split Tender: Allow customers to divide the payment amount, using both their credit card and cash for a single order.

- Partial Payments: Retailers can accept an upfront partial payment and collect the remaining balance through layaway payment plans or credit packages. Alternatively, partial payments can be collected in cash, with the option for customers to settle the remainder through an online invoicing service. Such payment methods have the potential to enhance your average order value (AOV).

Accepting a diverse range of payment methods offers transactional flexibility for both sellers and buyers. Choosing the right payment options tailored to your customer’s preferences is crucial when considering market expansion or aiming to enhance conversion rates.

Build Your In-Store Payment Experience Strategy

In recent years, there has been a significant shift in the perspectives of store owners regarding the customer payment experience. Moving beyond considering payment processing costs merely as a business expense, a growing number of retailers now recognize that payment methods play a pivotal role in:

- Providing a seamless and integrated shopping experience.

- Establishing a unique competitive advantage in the business landscape.

When formulating your payment strategy, consider initiating the process by asking yourself the following key questions:

- What are the expectations of my customers when it comes to the payment experience?

- How can I enhance the in-store payment acceptance to align with and exceed those expectations?

- In what ways can I design the checkout process to make the customer’s shopping experience more personalized and seamless?

- How can I organize and manage finances to enhance the overall customer payment experience?

- What is the optimal balance between prioritizing customer experience and implementing effective fraud management measures?

- How do evolving global data protection trends influence and shape my payment strategy?

- Which supplier or partner is the most suitable for processing payments in line with my business goals?

Addressing these questions strategically will empower you to develop a comprehensive and customer-centric approach to your payment methods, fostering a positive and competitive edge in the retail landscape.

Choose A Clothing Store Point Of Sale To Process Payments

When exploring various POS solution options, we recommend considering three key aspects in your decision-making:

Cost

The cost considerations of a Point of Sale (POS) system span both initial upfront expenses and ongoing fees. Businesses typically have options that include renting the system with a monthly or annual subscription fee or opting for the outright purchase of POS hardware and

software.

Certain POS providers may offer comprehensive packages, encompassing POS terminals, hardware, software, and payment gateway services. In some cases, these providers may even cover credit card processing fees as part of their bundled offerings.

It becomes essential for businesses to conduct a thorough comparison between the advantages of using a standalone POS system in conjunction with a third-party payment processing provider versus opting for an all-in-one solution that integrates both POS and payment processing functionalities.

This evaluation ensures businesses make informed decisions aligned with their specific operational needs and financial considerations.

Features

Tailor your choice of clothing store point of sale system features to the specific needs and complexity of your retail business. Anticipate potential changes in requirements as your business grows, ensuring the selected POS system can scale accordingly.

A recommended checklist for a robust POS system includes:

- Acceptance of EMV chips in credit and debit cards

- Support for mobile and contactless payments (swipe and tap options)

- Synchronization of loyalty programs both online and offline

- Digital receipt generation

- Printing of physical POS receipts

- Employee shift management

- Creation of comprehensive sales reports

- Effective product inventory tracking

- Barcode scanning functionality

- Secure cash storage in a designated drawer

Ease of Use and Support

- Given the significant time investment in system setup, configuration, and training, opt for a user-friendly POS system that minimizes effort.

- Ensure that the chosen POS provider offers reliable support to address any technical issues during sales operations.

Considering these factors will guide you in making an informed decision and selecting a clothing store point of sale solution that aligns with your business needs, both in the present and as you continue to grow.

ConnectPOS – Provide Payment Options And Checkout Experiences That Resonate With Your Customers

ConnectPOS emerges as a leading solution, offering a comprehensive platform that transcends traditional point-of-sale systems. ConnectPOS understands that the success of your business is intricately linked to the satisfaction of your customers, and we aim to elevate their shopping journey through innovative payment options and a frictionless checkout process.

- Tailored Payment Options: Whether it’s traditional card transactions, mobile payments, or emerging digital wallets, our system accommodates the diverse preferences of your customers. This flexibility not only enhances the convenience of transactions but also fosters customer loyalty by aligning with their individual choices.

- Seamless Checkout Experiences: Our intuitive interface minimizes wait times, reduces the risk of errors, and enhances overall operational efficiency. This commitment to a frictionless checkout ensures that your customers leave with not just their purchases but with a positive and lasting impression of your brand.

- Empowering Your Business: ConnectPOS seamlessly integrates with your current systems, streamlining operations and allowing you to prioritize building meaningful customer connections. Our adaptable clothing store point of sale solution ensures your business stays ahead of industry trends and technological advancements.

Embrace a forward-thinking approach to payments and checkout experiences, and let ConnectPOS redefine the way you connect with your customers. Elevate your business, streamline transactions, and leave a lasting impact with ConnectPOS.

FAQs About Payment Methods Integration In Clothing Store Point Of Sale

In this FAQ part, we delve into the key aspects of security, flexibility, setup, and customization to provide a comprehensive understanding of how the integrated POS system seamlessly merges convenience with cutting-edge features.

How Secure Are The Payment Transactions When Using Integrated Payment Methods In Our POS System?

Ensuring the security of payment transactions is a top priority in our integrated POS system. We implement industry-standard encryption protocols to safeguard sensitive customer data. Our system complies with Payment Card Industry Data Security Standard (PCI DSS) requirements, providing a secure environment for all payment transactions.

Is It Possible To Accept Both Traditional And Digital Payment Options Through The Integrated System?

Absolutely. Our integrated clothing store point of sale system is designed to be versatile, allowing your clothing store to accept a wide range of payment options.

From traditional methods like credit cards and cash to digital options such as mobile wallets and online payments, our system is equipped to handle diverse transactions, providing convenience for both your business and customers.

What Steps Are Involved In Setting Up And Maintaining Payment Method Integrations For Our Clothing Store’s POS System?

Setting up payment method integrations is a seamless process. Our dedicated support team will guide you through the configuration and ensure a smooth transition. Typically, the steps involve selecting the desired payment methods, configuring settings, and integrating with your chosen payment service providers. Maintenance is minimal, with regular updates and support to keep your POS system running efficiently.

Can The Integrated Payment Methods Be Customized To Align With Our Clothing Store’s Branding And Customer Experience?

Yes, customization is a key feature of our POS system. We understand the importance of aligning payment methods with your clothing store’s branding and customer experience. Our system allows you to customize payment interfaces, receipts, and communication messages, ensuring a cohesive and branded experience for your customers at every transaction.

In navigating the frequently asked questions about payment methods integration in clothing store POS systems, we’ve demystified the process and highlighted the key features. Elevate your payment transactions, prioritize security, and embrace flexibility with confidence using a suitable POS system.

Conclusion

As the retail landscape evolves, the integration of varied payment methods in clothing store point of sale systems emerges as a game-changer. Beyond mere transactions, this integration is shaping a customer-centric approach where convenience meets choice.

The ability to seamlessly adapt to diverse payment preferences not only streamlines operations but also solidifies customer loyalty. In the ever-evolving world of retail, the integration of payment methods stands as a testament to the industry’s commitment to providing an elevated and personalized transactional experience in clothing stores. Contact us if you wish to delve deeper into the details provided

►►► See our products: Magento POS, BigCommerce POS, Shopify POS, Woocommerce POS, NetSuite POS, Commercetools POS, Customize POS, Customer Experience Solution and Next-Gen POS