Understanding how much does POS system cost requires more than scanning price tags. Businesses must account for upfront hardware investments, licensing models, implementation, processing fees, and long-term support. While entry-level systems can start at $0 per month, the real cost of a POS platform lies in how well it aligns with operational complexity and future scalability.

This guide developed with insights from ConnectPOS, will examine every cost component from hardware to cloud subscription trade-offs, helping retailers and decision-makers make financially sound investments in technology.

Highlights:

- Costs range from $0/month to $10,000+, based on hardware, licensing, installation, and processing fees. Retailers should focus on total cost of ownership, not just initial prices.

- Retailers, restaurants, and food trucks have different needs. Multi-location or inventory-heavy setups cost more. Rentals help reduce costs for short-term use.

How Much Does POS System Cost?

The cost of a POS system is from $0 per month for a subscription and around $2,000–10,000 for a one-time payment model. The average cost of a POS system can vary depending on its license type. Many providers offer subscription licenses, requiring recurring fees for software usage. Alternatively, some providers offer perpetual licenses, allowing indefinite software use with the option to buy upgrades or support.

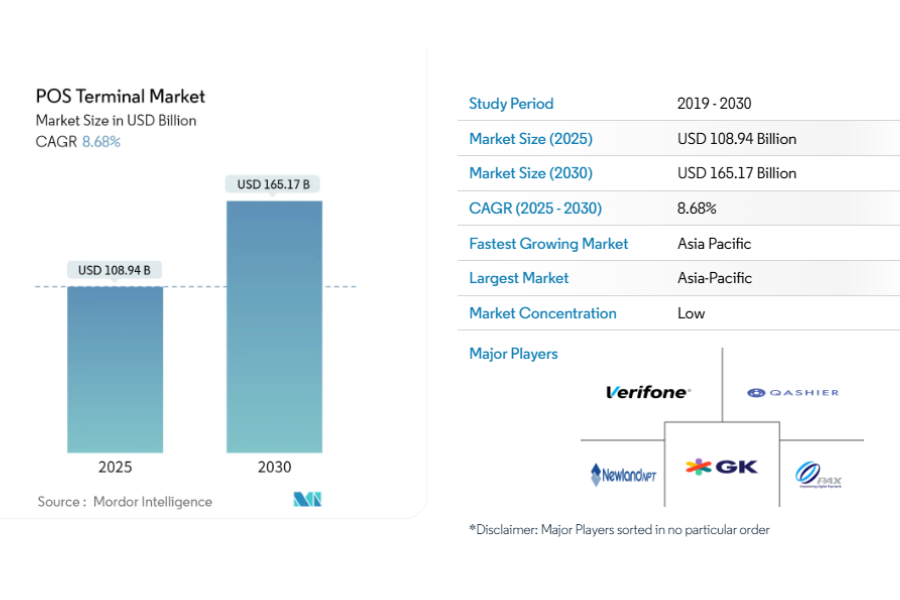

Before assessing the cost of a POS system, it’s helpful to consider market trends. Mordor Intelligence reports the global POS terminal market will grow from $108.94 billion in 2024 to $151.97 billion by 2029.

POS software is also set to rise from $14.76 billion to $41.53 billion by 2034. This growth reflects increasing investments in both hardware and software, which directly impact pricing across different system tiers.

How much does POS system cost depends on several variables beyond just the listed software price. Subscription plans can start at $0 per month, while one-time payment models usually range between $2,000 and $10,000. Pricing often depends on the type of license. Subscription-based licenses involve recurring fees, while perpetual licenses grant long-term usage, sometimes with optional upgrades or customer support.

Some POS software is available with a free plan. Total expenses depend on the complexity of the system, the hardware selected, and any custom work involved. Certain software works only on branded devices, while open source options are more flexible with device compatibility.

For short-term needs, small businesses might rent POS devices instead of buying full systems. Rentals, starting from $0 to $349 per month, work well for temporary setups like events where only payment collection is needed. Credit card processing fees also influence overall cost, especially for smaller retailers. Each business should evaluate its specific needs, since many elements affect pricing. There’s no fixed amount that applies to every case.

Detailed Breakdown of POS prices

POS Hardware Costs

POS hardware prices can range from $20 to $2,000, depending on what your business requires. Basic setups may need only a few items, while larger operations often invest in full hardware bundles. Common devices include:

- Card reader: $20–50

- Tablet stand: $50–200

- Barcode scanner: $30–100

- Receipt printer: $35–150

- Cash drawer: $5–200

- Touchscreen monitor: $250–800

- Digital menu board: $200–2,000

- Self-service kiosk: $200–700

Retailers and restaurants that take payments on the floor may opt for mobile card readers instead of fixed setups. For businesses with more than one location, hardware expenses can multiply quickly.

►►► Optimal solution set for businesses: Multi store POS, Next-gen POS, Inventory Management Software (MSI), Self Service, Automation, Backorders

POS Software Costs

Software costs typically fall between $10 and $250 per month. Pricing depends on the type of POS you choose:

- Cloud-based POS (SaaS): Subscription model with monthly payments

- On-premise POS: Higher setup fees but fewer recurring charges

- Hybrid POS: Combines elements of both models

On-premise systems may require more upfront investment in hardware and setup, while cloud-based POS appeals to businesses looking for flexibility and remote access.

Installation Costs

Installation costs vary depending on how complex the POS system is and the type of setup your business requires. Some solutions are easy to install with little technical knowledge, while others demand professional assistance and detailed configuration. Factoring installation into your evaluation of how much does POS system cost helps prevent unexpected expenses during rollout.

Installation Costs – Bullets

- Cloud-based POS systems: Generally easier to install and usually involve simple device configuration.

- Technical requirements: Often don’t require technical staff and can be set up by the business owner or in-house team.

- On-premise POS systems: Often need professional installation due to their reliance on local servers and infrastructure.

- Setup process: May require full network setup, software installation, and testing.

- Installation support cost: Can range from a few hundred dollars to over $1,000.

- Multi-location setup: May lead to extra installation costs at each business site.

- Vendor policy: Some include installation in the purchase price, while others charge it separately.

Additional Fees

There are several other fees to factor in:

- Credit card processing fees: A percentage of each sale, varying by provider

- PCI compliance costs: Charged monthly or annually

- Maintenance and updates: Particularly for on-premise systems

- Custom integrations: Charges apply when adding functions beyond default features

- Support services: Some vendors charge extra for dedicated customer service

These extra charges affect the total cost of ownership, so it’s helpful to evaluate both upfront and ongoing expenses before deciding on a POS system.

Price Comparison by POS System Type

There are three main types of POS systems: cloud-based, on-premise (also called legacy POS) and hybrid. Each model influences how much does POS system cost, depending on business size, infrastructure and feature needs. Hybrid systems blend the flexibility of cloud setups with the control of local installations. Costs vary by provider and industry, as retail and restaurant operations often require different configurations.

| Type | On-premise POS | Cloud-based POS | Hybrid POS |

| Hardware costs | $1,300–2,000 | $600–1,500 | $1,500–20,000 |

| Software costs | One-time payment | $0–200 per month | $60–200 per month |

| Installation costs | $0–5,000 | $0 | $0–2,000 |

| Total cost | $3,000–50,000 per year | $600–1,700 per month | $1,600–23,000 per year |

Each type suits different priorities, some businesses focus on long-term control, while others want quicker setup and lower entry costs. Pricing should be reviewed in context with long-term needs and technical preferences.

Industry-Specific POS Pricing

The kind of business you run directly influences how much does POS system cost overall. A setup designed for a clothing store won’t function the same way for a food truck. Each industry has unique requirements, some need only basic payment tools, while others rely on advanced features like inventory control, sales tracking, and reconciliation. The more functionality required, the higher the total investment. Below is a breakdown of typical POS expenses by industry:

| Industry | Installation Costs | Hardware Costs | Software Costs | Payment Processing Fees |

| Retail | $0–2,000 | $1,000–5,000 | $0–250/month, $0–60 per extra register | 2–3% |

| Restaurant | $500–10,000 | $2,000–10,000 | $0–250/month, $0–60 per extra register | 2–3% |

| Cafe | $0–2,000 | $1,000–5,000 | $0–200/month | 2–3% |

| Food Truck | $0–1,000 | $500–1,000 per truck | $0–150/month | 2–3% |

| Health & Wellness | $0–5,000 | $2,000–10,000 | $0–200/month | 2–3% |

This pricing table shows how POS systems are adapted to each sector’s workflow and transaction environment. Every business should match its POS investment to how it operates and what it sells.

Practices to Save up on Your POS System Investment

Selecting a POS system is more than a technical decision, it’s a financial commitment that affects daily operations and long-term scalability. To manage how much does POS system cost over time, apply the following cost-saving strategies.

- Audit Your Business Needs First: Don’t begin with the assumption that every function is necessary. List the core operational needs: payment processing, inventory management, sales tracking, staff permissions, or integrations with accounting software. Then map those needs to features. Avoid overspending on modules or add-ons that don’t translate to operational impact.

- Choose Scalable, Not Overbuilt Systems: Avoid purchasing systems designed for large-scale enterprises if you’re a single-store operator. Start with what supports your current capacity. Choose vendors that allow easy upgrades later rather than paying for unused functionalities upfront.

- Compare Licensing Models: Subscription-based models may look inexpensive at first but accumulate over time. On-premise systems involve higher upfront costs but may lead to savings in the long term. Run a cost projection over three to five years to find the most sustainable pricing structure for your operation.

- Source Hardware Separately When Possible: Many vendors bundle hardware and software, but this can limit flexibility and cost control. Check if your POS software is compatible with third-party devices especially if you already own tablets, scanners, or printers. Buying hardware independently often opens room for negotiation and supplier discounts.

- Evaluate Free and Open-Source POS Options: Some open-source POS platforms provide full access to source code, which can be valuable for custom development or integration especially for businesses with internal IT support. While these solutions often lack out-of-the-box support, they can dramatically lower recurring software costs if properly maintained.

- Consider Cloud vs. On-Premise Trade-Offs: Cloud systems require less IT infrastructure and are often easier to deploy across locations. But monthly fees can rise quickly as features and locations increase. On-premise setups involve more setup cost but may give you tighter cost control if security and autonomy are a priority.

- Leverage Vendor Trials and Demos: Test software before committing. A trial period lets you check performance, usability, and feature alignment. This helps avoid switching costs later and gives insight into how the system fits your workflow without guesswork.

- Negotiate Contract Terms: Never accept list pricing without discussion. Vendors often have flexibility, especially if you’re bundling services or committing to a longer contract. Negotiate setup fees, per-register charges, or transaction percentage rates.

- Keep an Eye on Payment Processing Rates: Your POS system might lock you into a specific processor, and small percentage differences matter over time. Compare rates across providers, including hidden costs like PCI compliance, chargeback fees, and batch fees. Where possible, choose POS platforms that allow processor flexibility.

How much does ConnectPOS cost? What makes ConnectPOS POS stand out from other POS solutions?

Pricing

ConnectPOS provides transparent and scalable pricing for retailers of different sizes. Costs typically start at $39 per month per device for the basic plan and increase depending on the required features, integrations, and number of terminals. For enterprise needs, ConnectPOS builds custom pricing based on deployment complexity, API needs, and volume. There are no hidden fees, and you can choose between monthly or annual billing cycles.

ConnectPOS also provides a free trial, allowing businesses to test features before committing. Compared to other cloud POS systems, it delivers high value without tying you to per-location, per-login, or per-transaction charges, making it financially viable as you grow.

What makes ConnectPOS stand out

- Unified Omnichannel Experience: ConnectPOS is built for retailers operating both online and offline. It integrates smoothly with eCommerce platforms such as Magento, Shopify, BigCommerce, and WooCommerce, providing real-time sync between your eCommerce storefronts and physical points of sale. Unlike standalone systems, ConnectPOS guarantees that inventory, customer data, and order details remain consistent across all sales channels without relying on third-party connectors.

- Device Flexibility: ConnectPOS supports desktop, tablet, iPad, and mobile across various operating systems (Windows, Android, iOS). Retailers aren’t forced into buying proprietary hardware and can choose devices that match their budget or reuse existing infrastructure minimizing upfront hardware investment.

- Support for Diverse Business Models: The platform serves retail, F&B, service providers, and pop-up models. It supports offline mode, allowing uninterrupted operations even without internet access. For larger operations, ConnectPOS can handle multi-warehouse, multi-outlet, and multi-currency setups that are suitable for global expansion.

- Customization and Integration: ConnectPOS provides API access, white-labeling options, and a strong partner network to support tailored implementations. Businesses with complex workflows or ERP integrations benefit from the system’s adaptability without heavy vendor lock-in.

- Global Presence and Support: With a global client base and support team across time zones, ConnectPOS delivers timely assistance and onboarding support. Businesses also get access to localized language packs and tax setups, making it easier to comply with regional regulations.

- Brand and Trust: ConnectPOS is backed by a strong reputation in the retail technology space, with over 12,000 customers and 200 global partners. The platform has earned industry credibility through consistent product performance and a track record of helping businesses scale across regions and verticals.

ConnectPOS positions itself as a commerce-ready POS built for unified operations. It stands apart by combining deep integration capabilities, flexibility in hardware and pricing, and a focus on multi-channel retail. While some systems prioritize either eCommerce or in-store, ConnectPOS is designed to support both giving retailers the infrastructure to scale sustainably.

FAQs: How Much Does POS System Cost

What is the average cost of a POS system?

The average cost of a POS system ranges from $ 0 per month for basic subscriptions to $10,000 or more for one-time payment models. Total cost depends on hardware, software, setup, and payment processing fees.

Compare POS system cost by types?

Are there free POS systems available?

If you’re wondering how much does POS system cost at the lowest tier, some providers have free plans. However, these typically include limited features, and most businesses upgrade for full functionality, integrations, or support.

What’s the difference between one-time payment and subscription-based POS systems?

One-time payment systems require a higher upfront investment and may include license ownership. Subscription-based systems spread costs monthly or annually and often include updates and support.

Is POS hardware included in the software pricing?

Usually not. Hardware and software are often priced separately. Some vendors bundle them, but it’s common to buy hardware from one supplier and software from another.

What is the total cost of ownership (TCO) for a POS system?

TCO includes the initial cost plus long-term expenses such as maintenance, upgrades, training, and support. Evaluating TCO helps in understanding long-run value.

Conclusion

Answering the question “how much does POS system cost” requires more than identifying a price tag. It demands a full assessment of your operational scope, long-term technology roadmap, and how well a POS system can support your growth trajectory. From hidden transaction fees to hardware compatibility and licensing structures, total cost of ownership varies greatly across industries and business models.

If you’re looking for a solution that balances pricing flexibility with enterprise-grade functionality, ConnectPOS provides a compelling option. With transparent plans, multi-device support, and real-time omnichannel integration, it is built to scale with your retail ambitions. Contact ConnectPOS today

►►► Optimal solution set for businesses: Shopify POS, Magento POS, BigCommerce POS, WooCommerce POS, NetSuite POS, E-Commerce POS