Point of Sale Systems in the US no longer operate as simple checkout tools. They influence how retailers manage inventory, handle sales tax, interpret data, and connect physical stores with digital channels. As the market shifts toward cloud-based and omnichannel models, POS selection has become a strategic decision tied closely to scalability and operational control.

This article from ConnectPOS shares practical insight into the US POS landscape, covering market dynamics, core capabilities, cost considerations, and the role of omnichannel systems in modern retail operations.

Highlights:

- Point of Sale Systems in the US reflect a shift toward cloud-based platforms shaped by compliance demands, omnichannel expectations, and data-driven retail operations.

- POS systems must support payment security, inventory visibility, tax handling, and reporting accuracy to meet operational and regulatory needs across industries.

- POS pricing extends beyond software subscriptions, covering hardware, transaction fees, integrations, and long-term scalability considerations.

Overview of the US POS Market

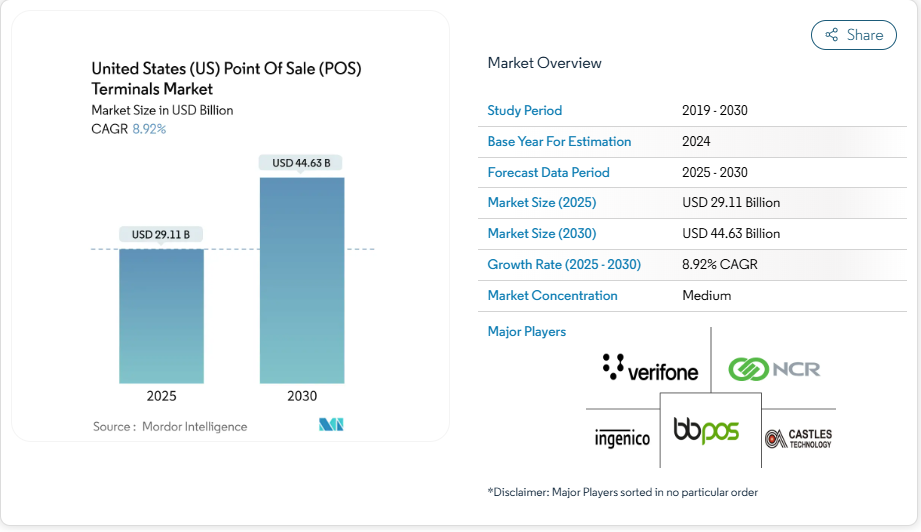

The US Point of Sale terminals market is projected to reach USD 29.11 billion in 2025 and grow to USD 44.63 billion by 2030, reflecting a compound annual growth rate of 8.92% over the forecast period.

At the same time, point of sale systems in the US are undergoing a structural shift away from legacy setups toward cloud-based architectures. Checkout terminals are no longer treated as standalone payment devices. They now operate as data hubs, consolidating inventory signals, transaction records, and customer loyalty information into a unified operational view.

This shift forces hardware manufacturers to move away from proprietary ecosystems, favoring open API architectures that allow third-party software integrations to handle complex logistics and labor management.

Sustainability in this landscape demands a departure from standard transaction processing. High-volume retailers face a reality where consumer behavior shifts weekly, requiring systems that adapt without expensive hardware overhauls.

Success in the current climate requires more than just a functional card reader; it requires a modular software stack capable of scaling from local storefronts to national franchises without losing data integrity. The focus has moved toward edge computing and real-time analytics, where the speed of a transaction matters less than the depth of the insight captured during those seconds of contact

Core Features of Point of Sale Systems in US

The Point of Sale Systems in the US landscape functions as a centralized intelligence hub where hardware and cloud-based software converge to manage complex retail operations. Modern commerce requires more than a checkout terminal; it requires a data-driven ecosystem capable of synchronizing payments, inventory, and customer insights in real time.

Payment Processing and Security

Modern commerce dictates a move toward end-to-end encryption and tokenization to safeguard sensitive cardholder data. The threat landscape shifts daily, making PCI compliance a baseline rather than a goal. Businesses prioritize systems that isolate payment data from the broader network, preventing lateral movement during a security breach. Contactless NFC technology and EMV chip readers provide the physical interface for these protections, shielding the merchant from liability while maintaining trust at the point of purchase.

Security protocols demand rigorous attention to detail beyond the physical terminal. Robust systems implement point-to-point encryption (P2PE) to turn data into indecipherable code before it even leaves the hardware. This architecture minimizes the scope of audits and protects the brand reputation. Security requires more than just a locked drawer; it requires a defensive perimeter built on zero-trust principles and rapid response capabilities.

►►► Optimal solution set for businesses: Multi store POS, Next-gen POS, Inventory Management Software (MSI), Self Service, Automation, Backorders

Inventory and Employee Management

Stock control involves tracking raw materials and finished goods across every sales channel in real time. Discrepancies between digital storefronts and physical shelves lead to missed revenue and frustrated clients.

Successful operators rely on automated low-stock alerts and purchase order generation to maintain lean operations. Precise tracking prevents capital from sitting idle in overstock while maintaining enough liquidity to meet sudden spikes in demand.

Staff oversight involves more than simple clock-in functions. Integrated scheduling tools allow management to align labor costs with historical sales data, preventing overstaffing during slow hours. Granular permission levels protect the system by limiting access to sensitive financial functions based on job roles. Effective management requires more than just a roster; it requires a feedback loop that connects individual performance to overall store profitability.

Reporting and Analytics

Raw data serves little purpose without a framework for interpretation, a challenge commonly addressed by modern point of sale systems in US. Decision-makers rely on dashboards that translate transaction records into usable insight on product margins and seasonal demand.

Identifying items that generate the strongest return on investment supports more informed merchandising decisions. High-level reporting reveals consumer behavior patterns that rarely appear in standard ledger entries.

Long-term growth depends on the ability to forecast future needs based on past performance. Aggregated data sets provide a roadmap for expansion or menu adjustments. Modern systems deliver these insights through automated exports that feed directly into accounting software. Insight requires more than just a list of sales; it requires a historical perspective that informs procurement and marketing budgets for the coming fiscal year.

Customer Relationship Management (CRM)

Direct engagement with the customer base happens through the collection of purchase history and preferences. Every transaction provides a data point that helps build a profile of a loyal patron. Personalization becomes possible when the system remembers a customer’s favorite items or birth date. This data allows for targeted outreach that feels relevant rather than intrusive, driving repeat visits without broad-spectrum advertising spend.

Loyalty programs work best when integrated directly into the checkout flow. Digital receipts and opt-in marketing lists turn a one-time buyer into a long-term asset for the company. The ability to track the lifetime value of a customer provides a clear metric for the success of various promotions. Retention requires more than just a punch card; it requires a repository of interactions that guide the business toward better service.

Integration Ecosystem

A standalone terminal creates an island of data that hinders growth. Connection points between the POS and external platforms like E-commerce, accounting, and marketing tools create a unified business environment. APIs allow for the exchange of information, meaning a sale on a website updates the stock levels in the warehouse instantly. This connectivity removes the need for manual data entry and lowers the risk of human error.

The choice of software often depends on the breadth of the available marketplace. Third-party developers provide specialized tools for niche industries that plug directly into the core system. This modularity allows a business to build a custom tech stack tailored to specific operational requirements. Flexibility requires more than just a software license; it requires a foundation that supports a growing network of interconnected applications.

Read more: Scaling Smart: How POS Software for Multiple Locations Reduces Complexity and Costs

Understanding POS Costs in the US

Operating a business in the United States involves a multi-layered financial commitment toward transaction technology. Total cost of ownership of Point of Sale Systems in the US extends beyond the initial purchase of a terminal, encompassing recurring service fees and variable transaction expenses. Financial planning for these systems requires a distinction between one-time capital expenditures and ongoing operational costs.

Hardware Costs

Physical equipment remains a significant upfront investment for any brick-and-mortar establishment. While entry-level mobile readers often have low barriers to entry, a full-service checkout station involves specialized peripherals.

- Countertop Terminals: Professional all-in-one stations typically range from $600 to $1,500 per unit depending on screen size and processing power.

- Mobile and Handheld Devices: Portable tablets and handheld scanners for tableside or floor service cost between $200 and $600 each.

- Essential Peripherals: Secondary items like receipt printers ($200–$400), cash drawers ($100–$250), and barcode scanners ($150–$300) add to the total station price.

- Kitchen and Display Systems: Industry-specific hardware like Kitchen Display Systems (KDS) for restaurants can reach $1,000 to $2,500 per screen for ruggedized units.

Software Subscription Fees

Cloud-based models have largely replaced permanent software licenses with monthly or annual recurring payments. These fees provide access to the platform, data security updates, and cloud storage for business records.

- Entry-Level Plans: Basic tiers for small vendors often start at $0 to $30 per month, focusing on simple payment acceptance.

- Standard Business Tiers: Mid-market solutions with inventory management and reporting usually fall between $60 and $120 per month per register.

- Enterprise and Multi-Location Plans: Complex operations requiring API access and advanced analytics frequently exceed $200 per month.

- Add-on Modules: Features like loyalty programs, online ordering integrations, or advanced labor management often carry separate monthly surcharges of $20 to $100.

Payment Processing Fees

Variable costs associated with credit card transactions often represent the largest long-term expense. These fees depend on the pricing model chosen by the merchant and the specific types of cards accepted.

- Flat-Rate Pricing: Simplifies budgeting with a consistent percentage (e.g., 2.6% + $0.10) for every transaction regardless of the card brand.

- Interchange-Plus Pricing: Passes the direct cost from card networks (Visa, Mastercard) to the merchant with a fixed markup (e.g., Interchange + 0.3%).

- Card-Not-Present Rates: Online or keyed-in transactions carry higher risk and typically result in elevated fees ranging from 2.9% to 3.5%.

- Debit vs. Credit Spreads: Direct debit transactions often process at a lower cost than premium reward credit cards or international cards.

Read more: Reduce Costs Across Your Operations with A Point of Sale Inventory Management System

Choosing the Right POS for Your Industry

Specific industry demands dictate the functional requirements of a system, shifting the focus from general transactions to specialized operational workflows. In the context of point of sale systems in the US, identifying the right platform depends on how closely the software’s core logic aligns with the daily realities of retail, restaurant, or service-based operations.

POS for the Retail Sector

Retail operations center on the synchronization of vast SKU counts across physical and digital storefronts. Real-time tracking prevents stockouts and overstocking by providing a clear view of current assets at any moment. Modern systems incorporate barcode scanning and automated reordering to keep shelves occupied with high-demand goods. Accurate inventory data supports a unified commerce strategy where a customer buys online and picks up their purchase in the store.

Effective retail management demands tools for handling returns and exchanges without disrupting the daily ledger. Systems track individual staff sales performance to assist with commission calculations and productivity assessments. Detailed product mapping allows managers to identify which categories generate the most profit. Retail success requires more than a simple cash register; it requires a logistics engine that monitors every movement of goods.

POS for the Restaurant Industry

Restaurant environments prioritize coordination between front-of-house staff and kitchen teams, an area where point-of-sale systems in the US play a central role. Kitchen Display Systems (KDS) replace paper tickets, providing chefs with clear orders and preparation times.

Table management tools track occupancy and turnover rates to help staff seat guests more effectively during peak hours. Integration with online ordering platforms prevents manual entry errors and keeps the kitchen workflow steady.

Payment flexibility in dining involves splitting checks and managing tips with precision. Handheld devices allow servers to take orders and process payments directly at the table, increasing the speed of service. Systems also monitor ingredient levels to alert management when specific items run low. Restaurant operations require more than a menu interface; they require a coordination platform that aligns guest expectations with back-of-house capacity.

POS for the Service Sector

Service-based businesses like salons or repair shops focus on appointment scheduling and resource allocation. Calendar integrations allow clients to book time slots online, which then sync directly with the provider’s availability. Automated reminders help lower the rate of no-shows and keep the daily schedule on track. Tracking the duration of specific services helps management understand labor costs and adjust pricing models accordingly.

Client history files store notes on past preferences and specific requirements for future visits. Professional service providers use these records to maintain consistency and build long-term trust with their clientele. Invoicing tools handle deposits and partial payments for projects that span several days or weeks. Service management requires more than a billing tool; it requires a relationship database that organizes time and talent.

ConnectPOS: The Leading Omnichannel Solution for US Retailers

ConnectPOS functions as a central hub for retail operations, linking physical storefronts with digital sales channels. This system synchronizes inventory and customer data across all touchpoints to provide a unified brand experience. It integrates with major e-commerce platforms like Shopify, Magento, and BigCommerce, allowing US retailers to manage global sales from a single interface.

Key Capabilities

- Real-time Inventory Synchronization: Stock levels update across every online and offline location immediately after a sale. This prevents overselling and helps maintain accurate stock counts during high-volume periods.

- Click-and-Collect Support: Customers buy products online and pick them up at a physical store location. This bridge between web and brick-and-mortar increases foot traffic and provides immediate gratification for the shopper.

- Unified Customer Profiles: The system tracks purchase history and preferences regardless of where the transaction occurs. Staff access this data to personalize service or apply loyalty rewards during checkout.

- Flexible Payment Processing: Support for diverse payment methods including credit cards, mobile wallets, and “Buy Now, Pay Later” options caters to current US consumer habits.

- Mobile Point of Sale: Store associates use tablets or smartphones to check out customers anywhere on the sales floor. This removes the need for traditional checkout lines and speeds up the transaction process.

- Offline Mode Reliability: Transactions continue even during internet outages. Data stores locally and syncs to the cloud once the connection returns, preventing lost sales or data gaps.

- AI-Powered Forecasting: The system identifies sales patterns and seasonal fluctuations to predict future stock needs. This data-driven approach helps managers determine which products to restock and which to discount.

- Integrated CRM: The POS CRM solution from ConnectPOS stores detailed customer profiles, including purchase history and preferred payment methods. Staff use these insights to suggest relevant products at the point of sale.

- Customizable Performance Dashboards: Users generate many detailed reports covering revenue, tax, and employee productivity. Filters allow for a clear view of performance by specific store location or sales channel.

FAQs

How much do Point of Sale Systems in US cost?

The cost of a POS system in the US typically ranges from free plans to around $300 per month, depending on features, number of locations, and required hardware.

Do POS systems in the US support contactless payments?

Yes, most modern POS systems in the US support EMV chip cards, NFC payments, and contactless wallets such as Apple Pay and Google Pay.

What is PCI compliance in POS systems?

PCI compliance means the POS system meets Payment Card Industry Data Security Standards, helping US businesses protect customer payment data and reduce fraud risks.

Why do US retailers prioritize omnichannel POS systems?

US retailers prioritize omnichannel POS systems because they require consistent inventory visibility, pricing control, and customer data alignment across physical stores, eCommerce sites, and marketplaces to operate at scale.

Conclusion

As Point of Sale Systems in US continue to shape how retail operations are run, the gap between basic transaction tools and true omnichannel platforms becomes increasingly clear. Systems that lack unified data, channel consistency, or adaptability often limit growth rather than support it.

ConnectPOS addresses these challenges through an omnichannel POS approach designed for US retailers operating across physical and digital touchpoints. For businesses reassessing their POS strategy or preparing for the next stage of expansion, ConnectPOS represents a direction worth careful consideration. Connect us now!

►►► Optimal solution set for businesses: Shopify POS, Magento POS, BigCommerce POS, WooCommerce POS, NetSuite POS, E-Commerce POS