Global expansion brings both opportunity and complexity for retailers. Payment infrastructure is often the silent backbone of this growth, yet it can be a major obstacle if not built for international scale. A true global POS system must handle cross-border payments, diverse tax regulations, and multi-currency operations while ensuring customer trust at every touchpoint. This article from ConnectPOS provides insights into what defines a global-ready POS and reviews the top 5 global payment POS solutions supporting businesses as they move beyond domestic markets.

Highlights:

- Beyond transactions, modern POS systems unify inventory, customer data, and payments across regions, creating a consistent experience while meeting local compliance demands.

- The best global payment POS solutions balance security, scalability, and adaptability, covering everything from real-time currency conversion to integration with global payment gateways.

- Top 5 solutions in focus reviewed demonstrate unique strengths in supporting cross-border growth, giving businesses clarity on which tool best matches their international expansion strategy.

What is Global Payment POS?

Global payment POS refers to a point-of-sale system that supports international payment processing, enabling businesses to accept transactions from customers around the world. It handles various currencies, languages, tax rules, and payment methods, making it ideal for companies that sell across borders or operate in multiple regions.

Why Businesses Need Global Payment POS Systems

Companies expanding across borders face operational pressures that extend beyond simple transactions. Payment systems must process sales while adapting to varied regulations, currencies, and customer expectations, requirements that traditional POS setups struggle to meet. This has positioned global-ready platforms as a foundation for international commerce.

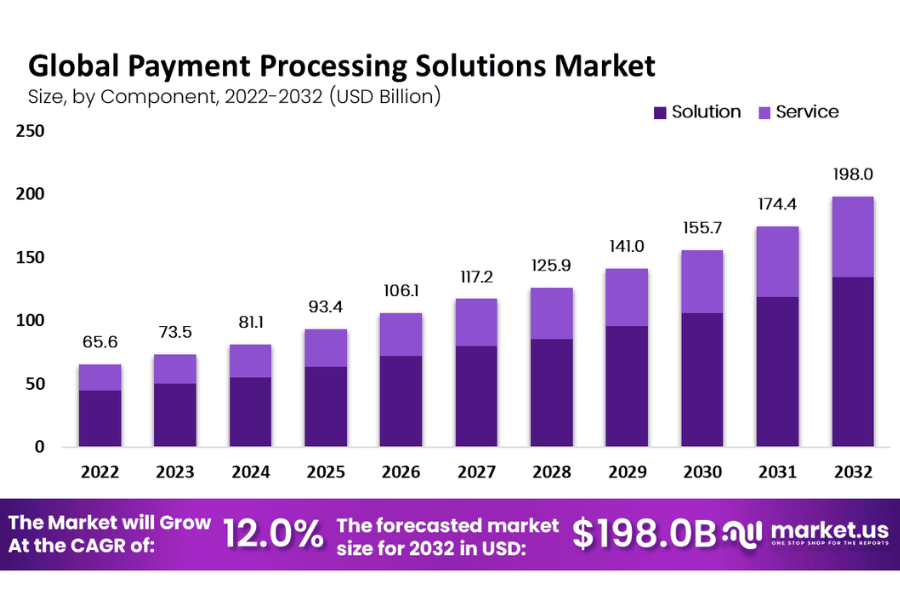

Market projections reflect the same momentum, with revenues forecast to reach USD 93.4 billion in 2025, climbing to USD 117.2 billion in 2027, USD 125.9 billion in 2028, and passing the USD 141 billion mark in 2029.

Handling Multi-Currency Transactions

For retailers serving customers across borders, currency handling often determines whether a transaction feels smooth or becomes a point of friction. A global payment POS platform can accept payments in local denominations while settling funds in the merchant’s preferred currency. This minimizes the risk of conversion errors and ensures transparency for customers who want to know exactly what they are paying.

Beyond retail convenience, this capability strengthens customer trust. A tourist shopping in Tokyo or a business traveler dining in London expects their card to be charged accurately, without hidden fees or confusing rates. Global POS systems address these expectations by automating currency recognition and integrating exchange rates, allowing merchants to provide clarity while safeguarding their revenue from miscalculations.

Compliance and Security Across Regions

Global payments are heavily regulated, and compliance failures can erode both profit and reputation. Different jurisdictions impose unique rules on data storage, transaction reporting, and customer verification. A global-ready POS must integrate compliance checks into the payment flow rather than treating them as afterthoughts.

For example, European businesses must process transactions under GDPR and PSD2, while firms entering the U.S. market face PCI DSS obligations. A system designed without these requirements in mind creates ongoing risk.

Consider the case of a retail group expanding into Southeast Asia. Each country applies its own standards for transaction monitoring and fraud detection. A POS system that embeds these rules into its architecture enables expansion without creating legal exposure. On the other hand, relying on a system that lacks regional adaptability often forces companies to build costly manual workarounds, which slow down rollout and create vulnerabilities.

Managing Cross-Border Fees Efficiently

Cross-border payments often carry hidden costs, including intermediary bank charges and fluctuating conversion fees. Without proper oversight, these expenses can erode margins and create unpredictable cash flow. Global payment POS systems provide merchants with transparent fee structures and consolidated reporting, allowing them to understand exactly where money is going and how to manage those outflows.

►►► Optimal solution set for businesses: Multi store POS, Next-gen POS, Inventory Management Software (MSI), Self Service, Automation, Backorders

The scale of this challenge is substantial. According to the World Bank, the average cost of sending remittances across borders stood at 6.18% in Q1 2023, far above the UN’s target of 3%.

For businesses processing thousands of international transactions, even small improvements in fee management translate into large financial gains. By centralizing data and reporting on charges, Global POS systems help retailers control operational costs and plan pricing strategies with greater precision.

Key Features to Look for in a Global Payment POS

Businesses need a platform that adapts to cultural, financial, and regulatory differences across regions. A global payment POS system built for global use should bring together operations, give clear visibility across borders, and support decision-making grounded in real-time data.

- Multi-Currency & Multi-Language Support: A POS that accommodates both reduces friction at checkout and creates consistency in customer experience. This flexibility also helps merchants manage conversion rates and exchange challenges without relying on external tools.

- Centralized Dashboard for Global Operations: Managing different regions from one hub saves time and reduces operational silos. A centralized dashboard gives management oversight of sales, inventory, and compliance across all markets. When every region reports into one system, decision-makers gain transparency and can act with greater speed and confidence.

- Integration with E-Commerce and ERP Systems: Global retail rarely operates in isolation. Linking the POS with e-commerce platforms and ERP systems connects physical and digital channels, while also aligning finance, supply chain, and customer data. The result is a more cohesive operational flow that supports expansion strategies and maintains consistency across diverse regions.

- Reporting and Analytics for International Sales: Cross-border commerce requires deeper visibility into performance metrics. Reporting tools within a global POS should cover region-specific trends, tax obligations, and customer behaviors. Access to these insights helps businesses adjust pricing strategies, plan inventory, and anticipate regional demands more effectively.

Top 5 Payment POS Solutions to Support Global Business Expansion

Expanding into international markets requires more than a payment processor; it demands POS systems that can handle diverse currencies, regional regulations, and customer expectations at scale. The right solution not only connects sales channels but also aligns inventory, compliance, and reporting across borders.

Below are five POS platforms positioned to help businesses grow globally with confidence and operational control.

ConnectPOS

Many POS systems are built to process transactions, but few are designed to support global expansion. ConnectPOS takes a different path by positioning itself as an infrastructure for cross-border growth.

This global payment POS allows companies to maintain brand consistency while adapting to the diversity of local currencies, regulations, and customer expectations. Instead of treating payments, inventory, and customer data as separate functions, the system connects them into a framework that scales across markets without losing agility.

Features

- Checkout process: Supports international and local payment methods, including credit cards, digital wallets, and region-specific gateways. Transactions can be processed both online and offline, preventing downtime during connectivity issues.

Inventory management: Built for global operations, the system updates inventory in real time, supports cross-border transfers, and automates replenishment when thresholds are reached. Businesses gain both a centralized overview and granular control at store level. - Order management: Unifies orders from eCommerce POS platforms, physical stores, and international marketplaces. Functions such as ship-from-store, click-and-collect, and cross-border delivery are integrated into one flow rather than handled in silos.

- Customer management: Maintains a unified customer profile while giving businesses the flexibility to tailor loyalty programs and promotions by region. This balance allows brands to deliver consistent identity while meeting local expectations.

Employee management: Provides tools to set access rights, track shifts, and measure staff performance across markets. This transparency is particularly valuable when managing distributed teams across different time zones. - Integration: ConnectPOS stands out for its ability to integrate with ERP, CRM, and local payment providers while aligning with tax and compliance requirements of each region. This ensures smooth operations as businesses expand into new territories.

- Reporting: Reports go beyond standard sales summaries. Businesses can view performance at a global scale while drilling down into specific regions, stores, or product categories. This clarity helps leadership teams make informed expansion decisions.

Pricing

ConnectPOS pricing plans start from $49 per month, with scalable options for enterprises managing larger footprints. The cost structure varies depending on the number of stores, integrations, and international scope. Businesses can engage directly with the ConnectPOS team to create a plan that reflects their growth strategy.

KORONA POS

KORONA POS is designed to serve merchants that need more than a payment processor. The platform connects directly with Global payments POS terminals and extends into the operational side of retail, from inventory oversight to customer engagement. It gives business owners the ability to manage sales, track goods in transit, process returns, and keep customers engaged with promotions and loyalty programs across locations.

Features

- Checkout process: Accept contactless payments, gift cards, and split transactions

- Inventory Management Software (MSI): Centralized control across locations, stock alerts for shortages or surpluses, automated order placement, vendor shipment tracking, and data import for new outlets

- Order management: Process refunds and returns with either money back or store credit

- Customer management: Capture customer data, run loyalty programs, and apply promotions across stores

- Employee management: Configure access levels and monitor staff shifts

- Integration: Connect with third-party apps such as loyalty platforms, accounting systems, and CRM tools

- Reporting: Access detailed reports covering revenue, profitability, returns, and transaction averages

Pricing

- KORONA POS Core – $59 per month, built for standard retail operations

- KORONA POS Retail – $69 per month, geared toward retailers requiring greater control over automation and inventory processes.

Heartland POS

Heartland POS is aPOS that integrates with global payments terminals to serve small and midsized restaurants and retailers. Its cloud platform links orders, inventory, and customer data while fitting the workflows of both hospitality and retail. The system manages peak-time demand, syncs information across departments, and supports consistent service from kitchen to checkout.

Features

- Checkout process: Accepts credit and debit cards, online transactions, mobile wallets, and QR payments; supports scan-to-pay for faster checkout.

- Restaurant POS: Manages online, mobile, and tableside ordering; allows delivery or pickup options; syncs modifications and dietary preferences in real time; balances incoming orders during peak hours; maintains loyalty programs; updates menus across channels and sites.

- Retail POS: Connects in-store and online orders; tracks stock and generates detailed reports; provides built-in CRM to create and manage customer profiles; syncs customer data across sales channels.

- Employee management: Assigns staff permissions and tip allocations; records working hours, attendance, and breaks; assists in staff scheduling.

- Reporting: Creates customizable reports updated in real time.

Pricing

Heartland POS pricing begins at $89 per month for the Essentials and Complete plans. Businesses seeking customized configurations or enterprise deployment are advised to contact the Heartland team directly for a tailored quote.

Lightspeed Retail

Lightspeed Retail POS is widely adopted in modern retail, built to handle inventory across stores and sales channels while unifying customer data, loyalty programs, and marketing. Integration with global payments supports flexible payment choices, including buy now, pay later.

Features

- Checkout: Accepts cards, deposits, and BNPL, with offline processing for uninterrupted sales.

- Inventory: Tracks stock and SKUs across stores, manages variants, creates purchase orders, imports supplier data via B2B catalog, and updates pricing in bulk.

- Orders: Syncs orders across channels, manages special orders, and supports delivery fulfillment.

- Customers: Builds unified profiles across channels, records purchase history, applies loyalty rewards, and supports promotions, gift cards, and tiered programs.

- Marketing & eCommerce: Runs SMS/email campaigns, applies post-purchase surveys, and expands selling on marketplaces, social platforms, and online stores.

- Reporting: Provides real-time, customizable sales and product insights.

- Integrations: Connects with ERP, accounting, marketing software, and global payments.

Pricing

Four plans available, priced by region, number of registers, and store locations. Extra charges apply for additional sites or devices, with consultation available for tailored pricing.

Epos Now

Epos Now connects its POS platform with global payments terminals, supporting both retail and hospitality operations under one system. This global payment POS helps businesses keep inventory accurate, manage customers consistently, and process transactions across locations.

Features

- Payment and Checkout: Supports cards, Apple Pay, Google Pay, and other wallets. Epos Now Payments is available at a flat 2.6% + $0.10 per transaction.

- Retail Management: Centralizes stock across online and offline channels. Barcodes, real-time counts, low-stock alerts, and automated purchase orders simplify inventory control.

- Hospitality Management: Handles dine-in, delivery, and click-and-collect from one place. Includes table ordering, floor plan tools, and kitchen display for smooth order flow.

- Customer Engagement: Synchronizes profiles across channels. Loyalty programs and promotions can run across online and in-store activity.

- Reporting and Analytics: Generates reports on sales, promotions, products, and staff, turning transaction data into actionable insights.

- Integrations: Connects with third-party processors, delivery platforms, and eCommerce systems to expand capabilities.

Pricing: Starts at $349 for software, terminal, card machine, and built-in printer in one package.

FAQ: Global Payments POS

Why should businesses consider global payment POS solutions instead of local ones?

Global POS systems handle diverse currencies, tax rules, and compliance frameworks, giving businesses a single platform to manage cross-border sales while maintaining operational consistency.

How do these global payments POS platforms support multi-currency and payment diversity?

They integrate with international payment networks, allowing acceptance of credit cards, digital wallets, bank transfers, and regional payment methods, while converting transactions into the company’s reporting currency.

Are these solutions scalable for mid-sized businesses aiming to expand abroad?

Yes. Providers such as ConnectPOS, Lightspeed, Heartland, Epos Now, and KORONA build systems that start small and grow with the business, adding new regions, languages, and integrations when required.

Conclusion

Global expansion isn’t just about selling more products or setting up new branches, it’s about building the right foundation for sustainable growth. At the core of that foundation lies a payment system designed to handle international complexity while respecting local needs. A forward-looking POS doesn’t just process payments; it drives customer trust, operational harmony, and revenue consistency across borders.

For businesses ready to compete on a global stage, the global payment POS solution from ConnectPOS delivers the tools to transform international challenges into growth opportunities. Contact us now!

►►► Optimal solution set for businesses: Shopify POS, Magento POS, BigCommerce POS, WooCommerce POS, NetSuite POS, E-Commerce POS